Each winter, dozens of finance students migrate to Athens to make their case for a chance to pitch stocks in one of the few in-person stock pitch competitions in the U.S.

Now in its 10th year, the University of Georgia Stock Pitch Competition — organized by UGA’s Student Managed Investment Fund (SMIF) and the Terry College Department of Finance — continues to earn a reputation as a place to meet future employers and mingle with colleagues.

SMIF president Tyler Ege, who graduates in May with degrees in finance and real estate and SMIF vice president Catherine Shih, who graduates in May with degrees in finance and management information systems and a certificate in Personal and Organization Leadership worked with finance professor Johannes Kohler, for more than six months to organize the competition — from recruiting sponsors to working out the minutia of getting teams from the Atlanta airport to Athens.

“I’ve planned smaller events, but nothing of this magnitude,” Ege said. “It’s just the sheer number of moving pieces.”

In addition to shepherding student teams to Athens, the team was responsible for signing up sponsors and judges for the event. The group secured a record amount of financial support from sponsor companies, including PIMCO, BlackRock, Angel Oak Capital Advisors, LCG Associates, Adams Street, Fulcrum Equity Partners, Capital Investment Advisors, Peachtree Group, CFA Society Atlanta and Morningstar.

“The Stock Pitch Competition has grown tremendously through our ability to maintain a strong reputation as a business school. Our students and alumni continue to give back so much support and that is how we can continue to achieve great things,” Shih said. “This year, we had 52 applications. Last year, we had a total of 28.”

Each year, the contest brings together investment professionals to judge student teams creating researched pitches for stocks they believe will be future good buys. Most team members are finance majors or students involved with their business school’s investment funds and competed in other stock pitch competitions before coming to UGA.

Of the 52 teams applying to be in the contest, the SMIF competition committee chose 15 to compete in Athens.

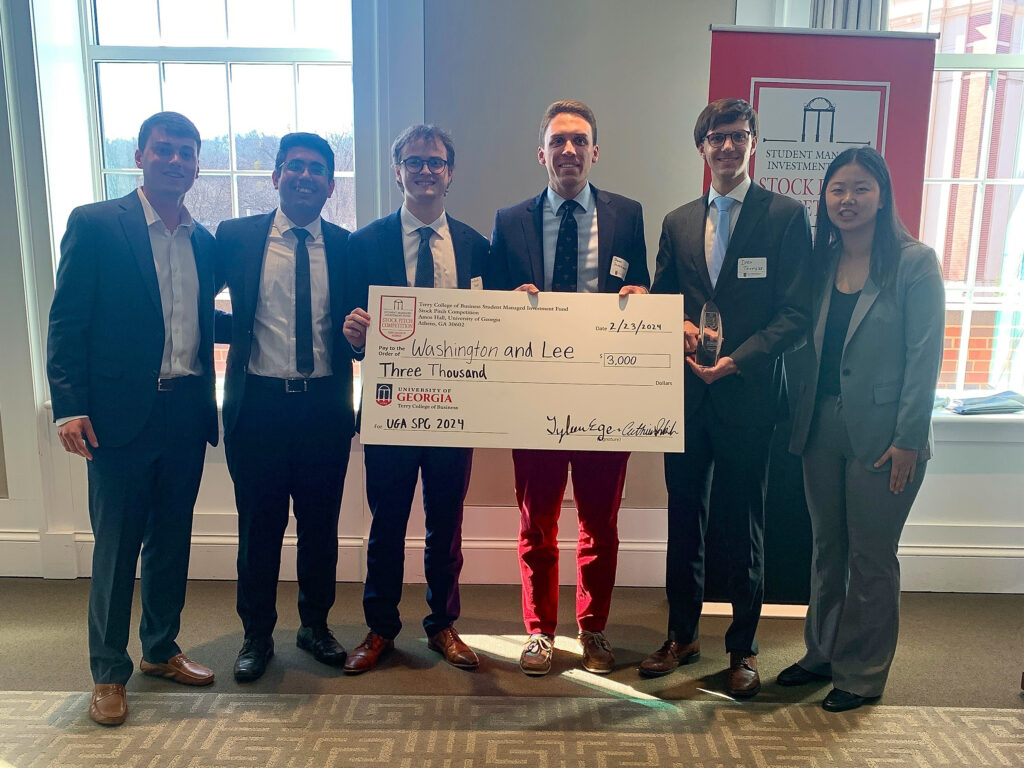

At this year’s contest, which was held Feb. 23 Stelling Family Study at the Terry College Business Learning Community, Washington and Lee University took home first place and $3,000. Bradford Bush, Diwesh Kumar, John Schieder and Andrew Thompson represented Wasthington and Lee, pitching CVS Health as an integrated healthcare stock that would only increase as more baby boomers become eligible for Medicare.

Florida State University, represented by seasoned seniors Cole Clemons and Mason Clemons, took home second place and $1,500 for pitching Landstar System logistics took home second place and. This is the second year both Washington and Lee and Florida State University have made it to the final round of competition. The teams tied for first place in 2023.

Southern Methodist University’s team — Chloe Cadelario and Carter Spence — took home third place and $500.

Whether teams make it the finals or not, the competition is always a great chance to meet to your future colleagues and learn from leaders in the investment industry, Shih said.

“You get to meet students from other schools,” said Shih, who represented UGA in last year’s competition. “It is a great opportunity to network with students across the country, and I think that the competition itself fosters teamwork and collaboration between students.”

The networking opportunity sets the UGA competition apart. Many stock pitch competitions are online, but SMIF has almost always held their competition in person.

In addition the finalists, this year’s contest included teams from New York University, University of Michigan, Auburn University, University of Florida, Kennesaw State University, University of Southern California, University of California-Berkeley, Miami University in Ohio, University of Texas-Austin, University of Notre Dame, Duke University, University of Pennsylvania, and UGA.

“We’ve been able to keep the competition sustainable through building a strong network between the SMIF board and our alumni,” Shih said. “By connecting students with the right resources and people willing to give back, we’ve developed a sustainable way to run and continue to grow this competition over the years.”